What are Indices Trading

Indices are measures to track the performance of a group of financial assets. Discover how to start indices trading with examples and its key benefits.

Table of Contents

Indices are popular financial instruments to trade in assets, including stocks, bonds, commodities, etc. However, many people are not aware of these instruments. In this article, we will learn about indices trading, its advantages, and how to do it.

What are Indices?

Indices or Indexes are measures to track the performance of a group of financial assets like stocks, bonds, or commodities.

FTSE 100, DJIA Wall Street, NASDAQ 100, DAX, and S&P 500 are amongst the most popular stock indices.

Meanwhile, the DXY – US dollar Index, EXY – Euro Index, and Vix – US volatility index are popular forex indices, and the S&P GSCI Index, the Bloomberg Commodity Index, and the DBIQ Optimum Yield are popular commodity indices.

Indices are the group of global companies formulated based on country, sector, or industry. Like, the S&P 500 is a group of 500 companies in the US with a large market cap.

What is Indices Trading?

Indices or Index trading is a process of buying and selling indexes to take advantage of their price fluctuation.

The concept of Indices in Trading is simple. Trader buy the indices when they feel their price will rise and sell when they feel their price will fall in the future.

Right prediction results in profit, and wrong prediction results in loss. Let us understand this with an indices trading example.

Suppose the price of the S&P 500 is around 4000$. A trader bought the index worth 20000$, predicting that their price would rise in the future.

In this case, his prediction goes right, and the price of the S&P 500 rises to 4050$, which means he had made a profit of 200$.

How to Trade Indices

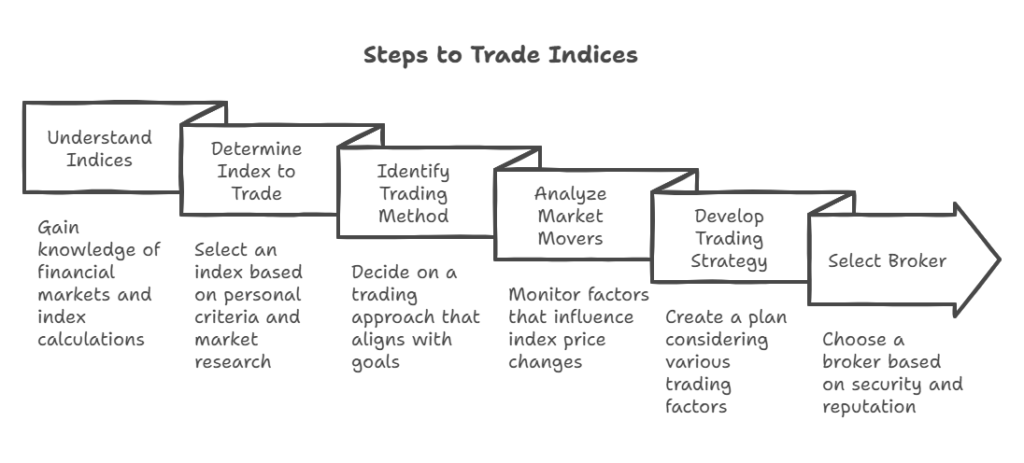

Trading in Indices is quite similar to forex or stock CFD trading. Here is a step-by-step procedure to trading indices and make profits in the market for beginners.

Understanding of Indices

The first step to start trading in any financial instrument is to make yourself well-versed with the financial market and how it works.

The index market is a vast market with different characteristics and functions. Trading requires knowledge of these features, which will help you in making the trade decision.

Also, there are different methods of index value calculation, like the Market Capitalization method, the price-weighted method, the equal-weighted method, etc. So, get knowledge of these methods before starting trading.

Determine the index to trade

There are numerous indices globally based on the country, sector, and industry. Selecting an ideal interest based on your knowledge, interest, capital, risk, and strategy is a crucial step.

After gaining knowledge of the index market, a trader should spend time in to study and comparing the best Indices to trade for beginners and choose an ideal index to invest in accordingly.

Identify the way to trade Indices

There are numerous indices globally based on the country, sector, and industry. Selecting an ideal interest based on your knowledge, interest, capital, risk, and strategy is a crucial step.

After gaining knowledge of the index market, a trader should spend time in to study and comparing the best Indices to trade for beginners and choose an ideal index to invest in accordingly.

What moves the Indices Market

Indices can be a group of forex stocks or commodities. Their price changes are caused due to different factors related to the asset.

Factors like financial news, economic events, speeches, reports, a company’s financial status, commodity market conditions, etc, result in changes in their price. So keep a watch on these factors and what impact they make on index prices.

Develop Indices Trading Strategy

For placing the right trade at the right time in the right index, you need a proper plan. Prepare an effective plan considering factors like trading objective, index type, analysis method, time frame, risk, capital, etc.

An effective strategy paves your way to success, better plan results in better execution. A good strategy contains all the crucial points and information that you require while placing a trade.

Select the Broker

For trading in the group of financial assets or indexes, you need to open an account with a registered and reputed broker.

Selecting a broker is not as easy as it looks; you need to check many factors like security, reputation, educational content, range of financial assets, leverage, capital protection tools, etc. Beirman Capitals offers a range of premium features to start index trading; contact our customer support to start trading with us.

Open an Account

For trading in the group of financial assets or indexes, you need to open an account with a registered and reputed broker.

Selecting a broker is not as easy as it looks; you need to check many factors like security, reputation, educational content, range of financial assets, leverage, capital protection tools, etc. Beirman Capitals offers a range of premium features to start index trading; contact our customer support to start trading with us.

Start Trading

Once you have opened an account, it is time to fund your account to start your trading expedition. Use technical, sentimental, and fundamental analysis tools to identify the right index to trade at the right time.

Place trade based on your analysis and customize your trade according to market conditions. Set proper entry, exit, stop loss, or take profit points for effective implementation.

Why Choose Indices Trading

There are many options or instruments to trade in, like currencies, stocks, bonds, or commodities. Therefore, novice traders may wonder why to choose an index over other assets. However, there are the following benefits you should know to start index trading.

Exposure to Global Assets with a Single Investment

One of the key advantages of trading indices is you gain exposure to global and different assets with a single investment.

In stock trading, you can trade in the stock of one company at a single trade. However, with index trading, you can trade in a group of stocks of major companies like the US, UK, Germany, etc, with a single trade.

Less Risky

A single stock, currency pair, or any asset is affected by different fundamental factors, and these factors cause significant changes in their price value.

It means the potential for huge profit or loss is high, and in unfavorable market conditions, you may suffer a big loss. However, while trading a group of stocks or assets, the risk is diversified, and even unfavorable market conditions will not affect your trade adversely.

Low Capital and Competitive Costing

Trading the CFD Index requires low capital, so even traders with little capital or little knowledge can start their trading journey with a small investment.

In addition, the charges of trading in indices are low as compared to the other instruments. So, it is a cost-effective option that does not require much capital.

Hedging

It is a loss-reducing strategy; traders invest in an asset with an opposite market condition than their present trade to manage the loss of one from the profit of another.

Indice trading can be a suitable option for hedger to offset the risk associated with their price fluctuation.

Leverage

Like any other CFD trading instrument, you can take advantage of the leverage facility in Index trading. Beirman Capital offers competitive leverage to our clients so they can control large positions with a small account balance.

Conclusion

Indices Trading for beginners is a great way to make money in the market with many benefits, including round-the-clock trading, low volatility, competitive costing, diversification, etc.

However, there are disadvantages, too, like complexity, lesser control, limited opportunities, etc. The advantages of index trading are more than the disadvantages; in addition, the market has the potential to make significant returns.

An effective approach, powerful analyses, excellent research, and the right psychology are the elements that will help you deal with all the limitations of trading indices and stay profitable.

FAQ

- Can I profit from index trading, and what are the risks?

Yes, you can make a profit trading index. Indices are generally the collection of financial assets such as stocks. So, the risk of indices trading is comparatively low.

- What does it mean to buy index futures?

A buy index futures is a derivative contract that allows a trader to buy an index at a specific price and date.

- How can risk be hedged with stock index futures?

Traders can enter buy or sell futures contracts to hedge the risk of stock index price fluctuations.

- Are index futures derivatives?

Index future is a derivative contract that allows traders to buy or sell an index at a specific date at a predetermined price somewhere in the future.

- Are indices better than forex?

Indices are better options for conservative, passive, and long-term traders. Meanwhile, forex is suitable for short-term traders who are willing to take potential risks.

Get Complete Forex Trading Assistance