Blog

Trump’s proposed $2 000 Tariff Stimulus Checks Require Congressional Approval

The tariff dividend checks of 2,000 proposed by Donald Trump have turned out to be one of the most talked about economic issues in the recent political and financial news.

Table of Contents

The concept is straightforward: the more money the US gathers in the form of tariffs on imported goods, the more of this money can be given back to the Americans as a direct payment. Its advocates refer to it as a tariff dividend. Opponents refer to it as unrealistic and inflationary.

Nevertheless, there is one important thing that is overlooked in viral headlines:

The proposed tariff stimulus check of 2,000 by Trump would have to be passed by Congress.

It implies that although the plan may be publicly announced, it cannot be made a reality unless it is passed by the lawmakers in the due process of law.

This paper describes what the proposal entails, how it might operate, and what effect it might have on inflation, Social Security COLA, stock markets, and international trade.

What Would fund Tariff Dividend Checks?

The basic idea behind the core funding is as follows:

Increased tariffs = increased government revenue = rebate checks.

In practice, however, it is a matter of the extent to which import activity persists following an increase in tariffs.

Since when tariffs are too high, firms will import less, and this will decrease the tariff revenue.

What is the $2,000 Tariff Dividend Proposal?

A tariff dividend check is under discussion as a possible $2,000 check to eligible Americans.

The proposal proposes the use of money collected in terms of tariffs instead of financing these checks by borrowing or printing money.

What are Tariffs in simple terms?

Tariffs refer to duties levied on imported products. For example:

- Assuming that a company imports products valued at $1 million.

- And the tariff rate is 20%

- The company remits $200,000 to the US government.

That two hundred thousand dollars is government income.

The concept of Trump is to reinvest part of that tariff revenue into the citizens, just like dividend payments in investing.

How Would Tariff Dividend Checks Be Funded?

The basic idea behind the core funding is as follows:

Higher tariffs → higher government revenue → rebate checks

In practice, however, it is a matter of the extent to which import activity persists following an increase in tariffs.

Since tariffs are too high, firms will import less, and this will decrease the tariff revenue.

Even with a higher tariff rate, total revenue can fall if trade volume drops.

That is why economists often say tariffs are an unstable funding source.

Timeline: When Could Americans Actually Get the $2,000 Checks?

Trump has proposed that such tariff dividend payments would be made by mid-2026, based on the speed of tariff policy implementation and approval.

However, one should be aware of the actual timeline issues.

To issue checks, the government would have to go through such steps as:

- Enacting a bill in Congress.

- Defining eligibility rules

- Setting up payment systems

- Establishing the funding mechanism.

- Monitoring tariff revenue appropriately.

In previous stimulus packages, it took months before payments were made after legislation was passed.

Therefore, although it can be a political timeline, mid-2026 is not a certain date.

Why Congressional Approval Is the Biggest Roadblock

This is the most significant section of the whole discussion.

Although a President may be in favour of tariff checks, the President cannot just send checks without the law.

Why?

Since stimulus payment requires:

- Federal budget allocation

- Spending authorization

- Approval from Congress

In the US system, Congress is in charge of key spending decisions. This is why numerous analysts make the same statement:

The tariff dividend checks proposed by Trump need to be approved by Congress.

This is also the reason why financial experts are wary of accepting this proposal as a policy that is a given.

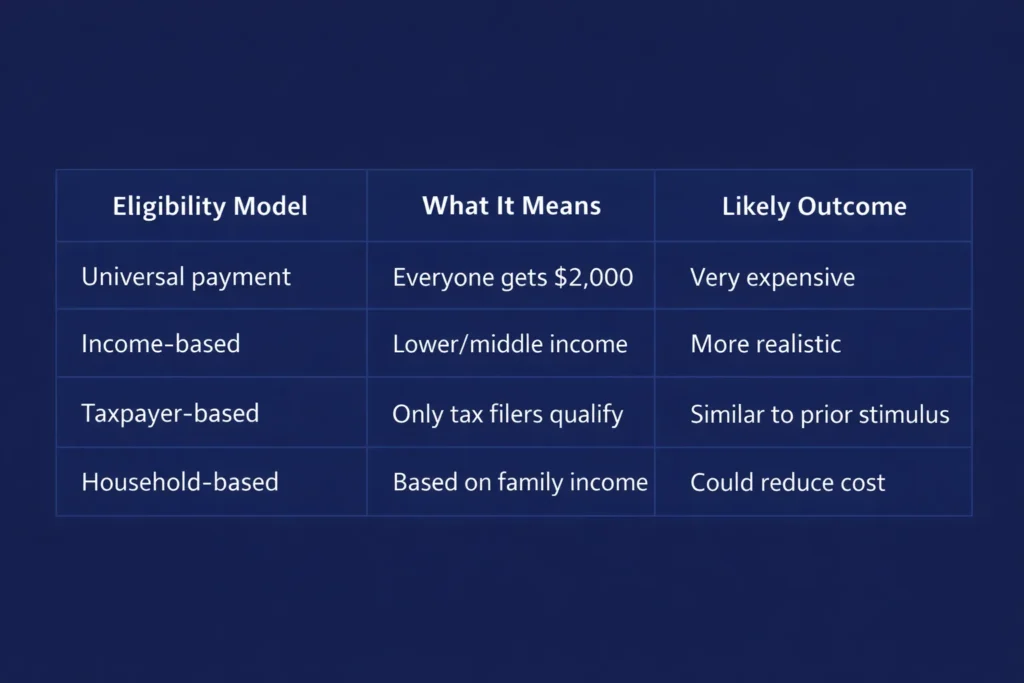

Who Might Qualify? (Income Limits and Eligibility Possibilities)

At this point, no officially confirmed list of eligibility for the proposed tariff rebate checks by Trump exists.

Nevertheless, according to the experience of the previous stimulus check, numerous analysts feel that the government can implement:

- Income limits

- Tax filing requirements

- Residency rules

- Household-based eligibility

Possible Eligibility Models

Income limit discussion

In case income limits are used, the checks might not be received by high earners. That would make the program less expensive and politically justifiable.

There is also a tariff dividend income limit that is discussed online, though until a bill is written by Congress, there is no official figure.

Why This Policy Is Being Discussed Now

One of the key elements of Trump’s economic messaging is tariffs. The idea is to push for:

- Greater local production.

- Less reliance on imports.

- Stronger position against China and international rivals.

Meanwhile, Americans do not forget about the direct stimulus checks of previous years.

Thus, the political appeal is obvious: a trade policy and a cash benefit.

Whether it is economically viable is another matter.

Will Trump Tariffs Increase Inflation?

According to many economists, tariffs may raise inflation particularly in the short run.

Here’s why:

- Tariffs raise the price of imported products

- Companies transfer expenses to customers

- Retail prices rise

- The pressure of inflation is heightened

Simple real-world example

When a company imports laptops into the foreign market, and a tariff adds 15% to the price, the company can increase the end price to the consumer.

It implies that Americans would pay more on:

- Electronics

- Clothing

- Home appliances

- Cars and auto parts

Although local production may be beneficial to some industries, the shift does not happen overnight.

How Tariffs Could Affect Social Security COLA in 2026

One of the biggest trending search topics right now is:

Will Trump’s tariffs increase Social Security’s 2026 COLA?

COLA is an acronym that means Cost of Living Adjustment and it is pegged on the inflation rates.

The connection is simple:

- Increased tariffs can increase the prices of consumers.

- Increased consumer prices may increase inflation.

- Increased inflation can raise COLA.

In theory, therefore, the tariff policies of Trump may result in an increase in the Social Security adjustment in 2026.

This is, however, not assured. Inflation is dependent on a lot of factors, such as:

- Interest rates of the Federal Reserve.

- Consumer demand

- Energy prices

- Global supply chains

Nevertheless, it is the reason why elderly people and investors with retirement in mind are keeping a close eye on tariff announcements.

Stock Market and Business Impact

Trump tariffs have been known to cause a severe response in the stock market.

The reason is uncertainty.

Tariffs can affect:

- Corporate earnings

- Import/export costs

- Supply chain stability

- Consumer spending

Common stock market reactions to tariff news

- There is an increase in short-term volatility.

- Technology and retail shares can respond adversely.

- The local production can be optimistic.

- International trade firms are under pressure.

Other market analysts have cautioned that tariff policies might raise inflation issues, which might affect interest rates and investor confidence.

As noted by financial companies such as Beirman Capital, policy uncertainty usually leads to short-term market volatility, particularly when trade wars are included in the decision-making process during elections.

This is the reason why the phrase stock markets Trump tariffs remains on the high search list in Google.

Global Response: China, Canada, and EU Retaliation Risks

Tariffs are rarely one-sided.

As the US increases tariffs, other nations might retaliate by increasing their tariffs.

China's response to Trump tariffs

China can retaliate by attacking US exports, including:

- Agriculture products

- Industrial machinery

- Technology components

This will decrease the US export demand and heighten trade tension in the world market.

Trump Canada tariffs angle

Canada is a significant trade partner of the US. Any tariff dispute with Canada can affect:

- energy trade

- automotive supply chains

- industrial manufacturing

EU ready to retaliate

The officials of the European Union also indicated that they might retaliate in case the US tariffs are increased. This may cause another wave of trade instability in the world.

In simple terms:

Tariffs may be a source of revenue, and they may be a source of international conflict.

Legal Challenges: Could Courts Delay or Block Trump Tariffs?

The other trending issue is whether the courts would be able to prevent tariff expansions.

Legal discussions have been made on several occasions regarding:

- The power of the president to levy tariffs.

- Trade law limits

- Lawsuits against businesses by the affected industries.

According to some experts, the large-scale tariff policies may be challenged in courts, particularly when they are extended in an aggressive manner.

In case courts postpone tariffs, the whole timeline of the tariff dividend check may change as well.

That is why people are searching for phrases such as:

- When will the Supreme Court decide on the tariffs of Trump?

- “Trump tariffs court”

Legal uncertainty is important to investors and consumers since it influences the speed at which the policy will be able to generate revenue.

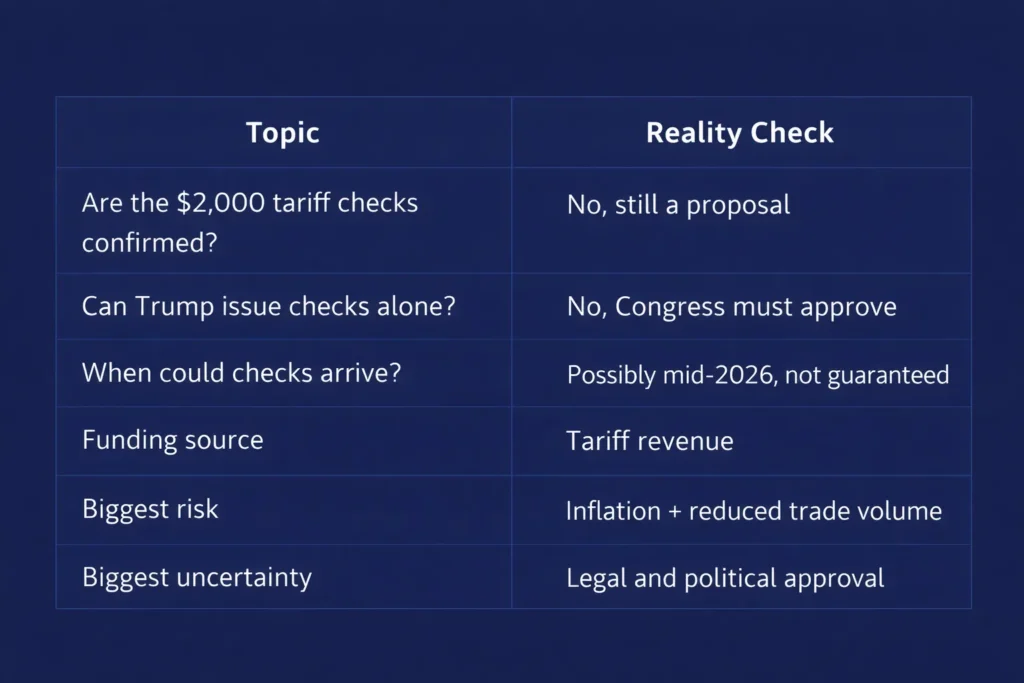

Key Takeaways (Quick Summary)

To make things simple, here is what Americans should know right now:

Final Thoughts: A Big Proposal With Big Uncertainty

The proposed tariff dividend stimulus checks of $2,000 by Trump are gaining attention as they are a combination of two potent concepts: tougher tariffs and direct payments to citizens.

But the greatest thing is still the same:

- The tariff stimulus check proposed by Trump needs to be approved by Congress.

- The checks are not guaranteed until a bill is passed by lawmakers, and there are no official rules of eligibility or income limits.

Nevertheless, this suggestion is important as it may influence:

- inflation trends

- The future of Social Security COLA in 2026.

- global trade relationships

- stock market volatility

Markets respond intensely, as companies such as Beirman Capital and other financial analysts frequently note, not only to the results of policy, but also to policy uncertainty itself.

Americans must, at this point, consider the tariff dividend plan as an emerging political and economic narrative, rather than a proven stimulus program.

FAQ

The proposed payment is the $2,000 check of Tariff Dividend, which is based on the revenue collected as import tariffs. It would redirect some of that revenue to qualified Americans pending Congressional approval and legislation.

Eligibility has not been stipulated. Legislators may use income caps, tax filing, or residence. The ultimate eligibility would be based on the Congressional laws and budgetary approval before the authorisation of payments.

Yes. Any payment of tariff dividends of more than 2,000 dollars would have to be approved by Congress since federal expenditure has to be approved by legislators. The plan can be proposed by the President, and legislation has to be passed by Congress before checks are issued.

No established schedule. Although Trump has indicated that payments might be received by mid 2026, a schedule is subject to Congressional approval, enacted legislation and successful execution of the funding structure.

It is based on tariff rates and volume of imports. Increased tariffs can raise revenue; however, decreased trade can decrease collections. Economists argue that the tariff revenue would not always provide sufficient funds to make nationwide $2,000 payments.

Get Complete Forex Trading Assistance