Forex Trading Sessions

Learn about four major forex trading sessions, including the Sydney, Tokyo, European, & New York, with their features, opening, closing & overlapping time.

Table of Contents

Have you ever heard the famous phrase, “Time is the most valuable thing a man can spend.” It is quite true and relevant, especially with respect to the forex market hours. You can earn and lose a large amount of money in currency trading because of one element time. In this article, we will learn about the four major forex trading hours, forex trading sessions and forex schedule for trading in currencies.

Forex market is the largest financial market, and the best part is it is open 24 hours, 5 days a week. You can trade in currencies anytime from anywhere. Making it essential to understand forex market times and forex business hours.

However, if you are wondering whether one should trade anytime in currencies, the answer is no. Different currency market opening hours and currency exchange market hours offer different conditions, including volatility, liquidity, risk, etc.

A smart trader knows how to play with time and make maximum money in the market. It is possible only when you learn about different forex market time, forex hours, and their key features.

Forex Market Trading Sessions

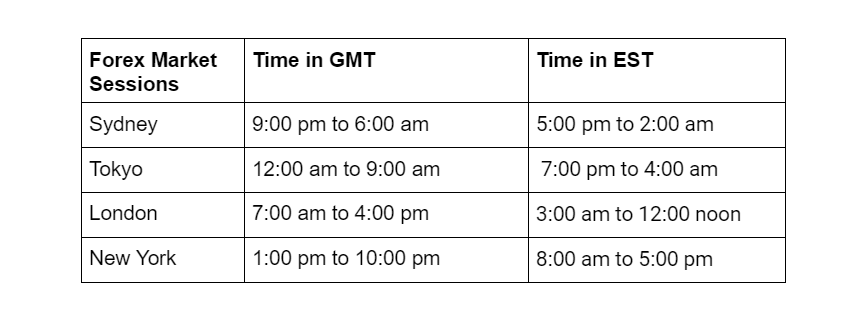

There are four major currency trading sessions, including the Sydney, Tokyo, European, and North American. Let us discuss each with its key features and timings.

Sydney Session

Forex trading week starts with the Sydney Session. It is also known as the Asian Pacific Session and offers comparatively low liquidity.

The market conditions are also not that good for trading in currencies.

However, major financial economies like Hong Kong and Singapore are active during this period. More than 7% of the transactions take place in these centres each.

Meanwhile, the economic data of Australian and New Zea Land was also released this time. So, the session is suitable for trading in AUD and NZD currency pairs.

Tokyo Session

The Tokyo session offers less liquidity as compared to the London and American sessions, however, more than Sydney. There are a significant number of forex transactions occurring in this session as Japan is active during this time.

Japanese Yen is the third most traded currency in the world, and more than 16% of transactions occur in Yen. It makes the Tokyo session popular among traders for trading in Asian currencies like JPY/USD, EUR/JPY, JPY/GBP, etc.

European Session

London or European sessions offer excellent market conditions, high liquidity, less volatility, and low trading costs. More than 40% of transactions take place in these sessions.

London Session overlaps with Asian and American sessions, making it suitable for all traders trading in different currency pairs. This session is ideal for trading in major and minor pairs like EUR/USD, GBP/EUR, CHF/GBP, JBP/EUR, etc.

North American Session

It is also known as the New York Center, as New York is amongst the strongest financial centres globally. The session offers high liquidity, tight spread, low volatility, and overall good market condition.

Also, data from the most significant economies were released during this period, which increased the exchange activities. In addition, the US Dollar is the strongest currency, and almost 88% of forex transactions occur in USD.

The session also coincides with the New York Stock Exchange (NYSE) timing. Thus, traders also get the benefit of stock market trends impacting forex. During this period, you can trade in significant pairs like USD/JPY, EUR/USD, CAD/USD, GBP/USD, etc.

Best Forex Market Hours

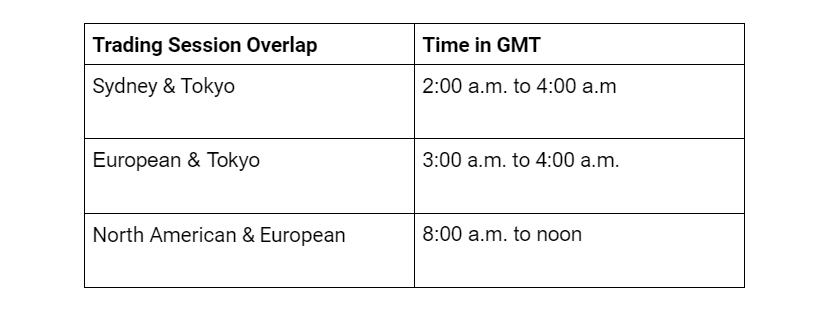

One of the most common questions of beginner or novice traders is regarding the right time for trading in currencies. Many mentors and forex experts believe that overlapping is the best time to trade in currencies, and this is true also.

Overlap is when two tradings sessions are open at the same time. Each currency trading session has its opening and closing time, and it opens for almost nine hours.

Due to this, three time a day, two session remains open for a few hours, and that’s the perfect time for a trader to trade. Here is a table showing overlapping periods in Green Wich Time.

The traders from the two sessions are trading; as a result, there are many buyers and sellers, high liquidity, and significant data releases during this period.

However, one should also understand that the right trade timing depends on the currency pair, risk, and strategy. During overlap, major data releases cause unexpected price swings and high volatility.

The European and American session overlap hours are considered the best for trading. The majority of transactions take place during this time.

However, it may not be suitable for a person trading in a JPY/SGD pair. The best time for him is during Sydney and Tokyo Overlap when both Singapore and Japan are active.

That’s why a basic understanding of the foreign exchange market and its factors is essential for using elements like time, risk, leverage, spread, volatility, liquidity, etc, for trading effectively and maximizing the desired results.

Wrapping Up

You can trade in over 180 currency pairs in 24 hours and 5 days, but it does not mean you should trade any time and any pair. A trader should have a clear strategy of when he will trade and which pair to trade.

Have you ever wondered if one can trade 24 hours in a day, then what is the need for dividing forex trading sessions into four categories?

The reason is each session has some unique features. Some traders prefer trading high liquidity, while some prefer low. Also, the overlapping hours of London and American sessions are suitable for short time frame styles like scalping and day trading.

Trading session diversification helps traders take advantage of different market conditions and trade effectively. So, you should trade currencies considering these sessions.

FAQ

What are the 4 sessions in forex?

European, North American, Sydney, and Tokyo are the 4 sessions in forex.

What is the 5-3-1 rule in forex?

The 5-3-1 is a popular forex strategy where a trader selects 5 currency pairs and 3 different trading strategies to trade at a 1 time to trade.

What are the forex session times?

Sydney 9:00 pm to 6:00 am GMT

Tokyo 12:00 am to 9:00 am GMT

London 7:00 am to 4:00 pm GMT

New York 1:00 pm to 10:00 pm GMT

Which session is best to trade forex?

The best session for trading in forex depends on a currency pair. However, the North American session is the most ideal for trading in major forex pairs.

Most active forex sessions?

European and North American are the most active forex sessions.

Get Complete Forex Trading Assistance