Best Forex Pairs to Trade

Discover the best forex pairs to trade in 2025 for a profitable journey. Boost your strategy with top picks and maximize your gains in the forex market.

Your profit in the forex market depends highly on the currency pair you are trading in. The biggest mistake a person can make in trading is randomly selecting any of the pairs. To help you, we have prepared a list of the Best forex pairs to trade in. However, before that, let us first quickly have an overview of currency pairs.

A currency pair can directly impact the capital requirements, risk-to-reward ratio, and trading strategy. So, the first thing you need to do is choose the right pair.

Understanding the Basics of Forex Pairs

A Forex or currency pair is a combination of two currencies that are exchanged in the market. It represents the value of one currency against another.

Traders buy or sell currencies in the forex market to take advantage of their price fluctuation. To buy one currency, the trader needs to sell another currency. And the combination of these currencies makes a forex pair.

Let us study with an example of a USD/JPY pair. The first currency of a pair is the base currency, while the second is the quote currency. In the example, USD is the base currency, while JPY is the quote.

Now, suppose the exchange rate of USD/JPY is 150.48. It means that to buy 1 USD, a person needs to pay 150.48 Yen.

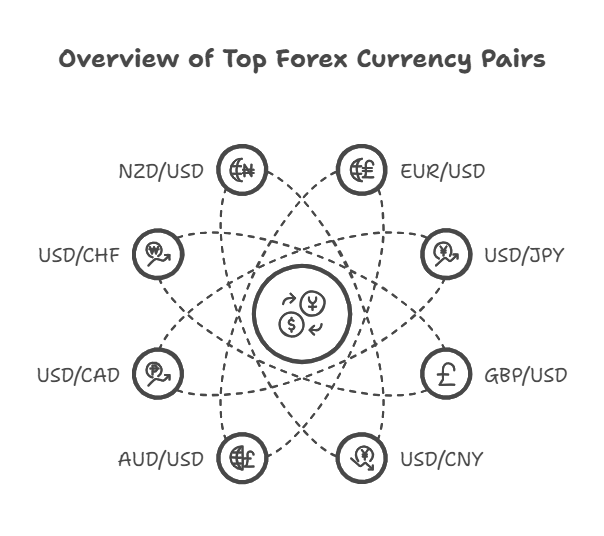

10 Best Forex Currency Pairs to Trade

Selecting the right currency pair out of 180 pairs is quite tricky. However, not to worry. Here is the list of top Forex pairs that we have prepared after proper research and analysis:

EUR/USD

The EUR/USD is the first in our best forex pair list. The pair is amongst the most traded forex pairs with high trading volume and excellent market liquidity.

The US dollar is the strongest currency, while the euro is the second strongest currency in the forex market. These two significant currencies dominate the entire forex world. So, the pair consisting of these two currencies will be of high value.

The best part about this pair is that you can identify many opportunities daily. In addition, the forex pair offers stable market conditions, making it ideal for beginners. Traders can trade this pair anytime. However, the overlapping timing of European and North American forex sessions is best for trading it.

USD/JPY

Japan’s technological and automation influence made the yen a powerful currency. Thus, combining the Japanese Yen and the US Dollar is a must for trade. The pair offers high liquidity and low forex spread trading.

The Bank of Japan and Fed interest rate announcements directly impact the USD/JPY pair, resulting in significant opportunities in the market. Traders looking for an alternative USD/EUR pair can surely go for this pair. Also, USD/JPY strongly correlates with USD/CAD and USD/CHF. So, traders can take advantage of these correlations.

GBP/USD

GBP/USD is another suitable currency pair option for new traders. According to a report, around 11% of total forex transactions occur in GBP/USD. The pair is highly liquid and less volatile with a tight spread. Traders who are afraid of taking high risks can go for this option.

Regarding the British pound, there was a time when the GBP was stronger than the US Dollar. However, after World War II, GBP saw a significant drop. But even today, it is amongst the strongest currencies to trade in.

Also, the GBP/USD has a positive correlation with the EUR/USD pair and a negative correlation with USD/CHF. So you can give the pair a try for trading in the forex market.

USD/CNY

China is amongst the fastest-growing economies in the world. China’s high trade balance surplus and significant global market influence make the Renminbi a powerful currency.

In addition, the dynamic political relationship between the USA and China results in potential trading opportunities. Therefore, USD/CNY ranked fourth in our best forex pairs to trade list.

However, the pair may not be ideal for new traders or traders with a lack of market understanding. Predicting the rise and fall of USD/CNY is quite complex due to high volatility and significant risk.

AUD/USD

AUD/USD is a profitable forex pair, especially if you are interested in the commodity market. The Australian economy is highly dependent on the export of commodities like iron, coal, natural gas, gold and many other products.

Australia’s significant influence on the commodity market makes AUD a suitable option for trade. The high demand for these products is positive; meanwhile, low demand for these products is negative for the AUD/USD pair.

No doubt AUD/USD is amongst the best Sydney session forex pairs. However, commodity market correlations make the pair highly volatile. The significant and frequent price swings with this pair result in high risky trading.

USD/CAD

The combination of US and Canadian Dollars is also worth trading. Canada is amongst the significant trade partners and a neighbour of the USA. Also, the Canadian economy is strongly correlated with the oil market as the country is a major oil exporter.

Therefore, it is a must for USD/CAD traders to watch the oil market. The rise in oil prices is generally positive for CAD and negative for USD/CAD. Meanwhile, the fall in the oil price is positive for USD/CAD.

However, for trading in the USD/CAD pair, a trader needs to watch many other factors. It includes the US and Canada relationship, central bank announcements and overall market conditions.

USD/CHF

The Swiss Franc is known as a safe-haven currency in the forex world. It has been seen that during inflation, political tensions and worldly crises, CHF has maintained its value or seen an increase. However, the currency may experience a downfall during economic stability or when other currencies are growing.

Nevertheless, the Swiss Franc is among the favourite options for traders and investors to hedge inflation. The spreads for trading the pair are also competitive, ultimately increasing the profit amount.

NZD/USD

The New Zealand Dollar is also a popular choice for trading in the forex market. Like the Australian Dollar, the NZD also strongly correlates with the commodity market. The country is the top exporter of many products including woods, dairy, Nuts, and meat.

The diverse market conditions of NZD and USD make NZD/USD a suitable trading option. Traders keep a watch on the commodity market to trade in this pair. Also, the pair is more volatile than other major pairs, so volatility lovers can go for it.

EUR/JPY

Well, if you are looking for the best minor pair to trade in, you can go for EUR/JPY. Both the currencies of the pair have strong demand throughout the world. On the one hand, Japan is leading the world in technology. Meanwhile, the EURO Zone dominates the world due to political powers.

The distinct nature of JPY and EUR has contributed to their popularity among traders. The minimum spread for trading in JPY/EUR is around 1 pip. You can trade the pair during the overlapping hours of Asian and European sessions.

USD/HKD

Hong Kong Dollar is also a good option for trading against the USD. The pair is exotic, so the market conditions may not be as stable as those of major pairs. However, traders looking for exotic pairs can go for this pair.

Also, the Hong Kong dollar is pegged against the USD. This means that the price will fluctuate in a specified range against US dollars. So, even beginners can trade this pair without any fear of big losses.

Wrapping Up

We have a detailed study on the best forex pair to trade in. However, remember one thing the right currency pair also depends on certain factors. It includes trading time frame, risk-taking capacity, capital, strategy, leverage, etc.

So, when you are choosing a currency pair, analyze whether it suits your needs. In addition, educate yourself about the pair, its features, and how it reacts to market change. It will help you in making plan your trade accordingly and make trade decisions effectively.

FAQ

1.What is Minor and Exotic Forex Currency Pairs

Though they have greater spreads with less liquidity than major pairs, minor currency pairs (cross currency pairs) do not involve the US dollar and remain tradable. There are EUR/GBP, GBP/JPY, and EUR/CHF among them.

Exotic currency pairs have more spreads, least liquidity, and involve currencies from developing nations. Among these are USD/CLP, EUR/RUB, GBP/SGD, USD/TRY, and USD/ZAR.

2. What is Technical and Fundamental Analysis of Currency Pairs

Technical analysis looks at price charts of a financial instrument, using technical indicators or price action to attempt to predict future movements in price.

Whereas, fundamental analysis attempts to predict price movements based on macro economical data and news releases.

3. Which currency is stronger in forex?

1. Kuwaiti Dinar 1 KWD = 3.26 USD

2 Bahraini Dinar 1 BHD = 2.65 USD

3 Omani Rial 1 OMR = 2.60 USD

4 Jordanian Dinar 1 JOD = 1.41 USD

4. What is the most traded pair in forex?

The EUR/USD is the most traded of all forex pairs in the world. That’s largely because it is the two biggest western economies trading against one another.

5. What is the safest forex pair to trade?

What are the Most Stable Currency Pairs? The least volatile and thus the most stable forex pairs are majors: EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, GBP/JPY, EUR/JPY, and USD/CAD.

Get Complete Forex Trading Assistance