Fair Value Gap: FVG Trading Strategy & Fair Market Value Guide

A Fair value gap occurs during the imbalance between buyers and sellers. Discover how to use the FVG trading strategy with pros and cons.

Table of Contents

Trading is full of concepts and technicalities that help you in identifying potential opportunities. Fair value gap is one such important technical analysis concept that is really useful to traders.

Wait, you have not heard of fair value gap or FVG trading? Well, not to worry. In Beirman Capital’s blog, we will discuss the fair value gap indicator, how to identify and trade it, with pros and cons. So that you can even use the strategy and make money in the market.

What is a Fair Value Gap?

A Fair value gap occurs during an imbalance between the buyers and sellers in the market. When there is a difference between the closing price of an asset in one period and the opening price for the next period.

A fair value gap can be defined as a missing piece in a puzzle. When looking for a gap, traders can identify a missing candle in a chart. Traders can identify these gaps and determine upcoming trading opportunities.

Types of Fair Value Gap

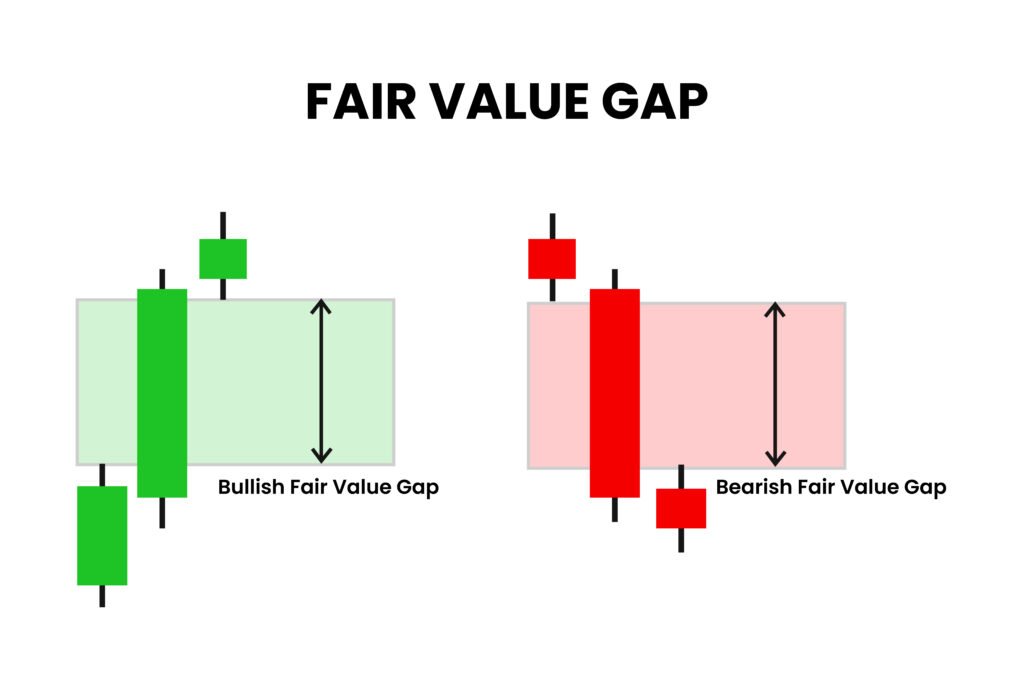

Bullish fair value gap: A bullish fair value gap occurs during a strong upward move. It consists of three candles. A bullish FVG is the price range between the high price of the first candle and the low price of the third candle.

Bearish fair value gap: A bearish fair value gap occurs during a strong and aggressive downward move. It consists of three candles. A bearish FVG is the price range between the low price of the first candle and the high price of the third candle.

What causes the fair value gap

News or Economic Releases: Generally, a release of big news such as NFP, FED Authorities announcement, data releases, or any other event can cause a FVG.

Market Sentiment: A significant shift in the market mood that causes sudden price swings.

Big Players Activities: When market makers engage in placing big orders, leading to quick price movements.

High Volatility: During large price swings in an asset price over a period.

Supply and Demand Dynamics: When there is a significant imbalance between supply and demand conditions.

How to Trade the Fair Value Gap

Identifying and trading fair value gaps is quite easy. Follow the steps below to do so:

Spot the Fair Value Gap:

For identifying an FVG, look for a triple candle pattern in a chart. Watch the wicks of the first and third candles. The first candle should be strong in one direction.

The second candle should continue the trend, creating a gap between the first and third candles, and the third candle should not overlap the first candle.

If you are having trouble identifying the FVG gap, you can use the fair value gap or plot the fair value gap scanner on the chart.

Wait for price revert:

When a fair value gap occurs, price is expected to revert to fill the gap and again continue the prevailing trends. So traders should wait for the price to revert.

Plot Indicators:

A fair value gap is not enough for entering the trade. So traders should plot indicators such as Bollinger bands, RSI, support and resistance, or moving averages to confirm their interpretations.

Place buy or sell Trades:

During a bullish FVG, when the price reverts to the gap, traders can consider opening a buy position, hoping for a price continuation in the upward direction.

During a bearish FVG, when the price reverts to the gap, traders can consider opening a sell position, hoping for a price continuation in the downward direction.

Pros of FVG Trading

Diverse Market Applicability: A fair value gap occurs in stocks, cryptocurrencies, forex, indices, and all other financial markets. That means you have a knowledge of FVG basics, then you can trade diverse products.

Track Institutional Traders’ Activities: A fair market value gap generally occurs when big players make trades that cause a sudden price change. Thus, traders using strategies such as ICT trading or smart money concepts can track big players’ activities by watching the FVG.

Low Risk Trading: A FVG trading is all about identifying price inefficiencies and imbalances. So the trading risk is comparatively less with this strategy.

Enhanced Trade Decisions: When fair value gaps are combined with technical analysis indicators and concepts, it provides a comprehensive market overview. It helps traders in identifying the exact trade entries and exit points.

Cons of FVG Trading

Not a Guarantee to Success: When a fair value gap occurs, a price is expected to reverse to the gap and then continue trading. However, it’s just an interpretation; there is no guarantee that the price will move in the same way.

Limited Opportunities: A fair value gap occurs rarely in an asset during a big event, news releases, or high market volatility. So there will be limited opportunities, and you cannot frame your entire strategy based on this concept.

High Volatility and Choppy Market Conditions: A fair value gap generally occurs during high volatility and choppy market conditions that cause sudden price swings. However, these conditions make the market unpredictable and trading a little difficult.

Final Words

A fair value gap trading is undoubtedly a great strategy to trade diverse assets. It gives a high return at low risk, providing a comprehensive view of the asset price.

However, when trading price inefficiencies, proper knowledge and practice are a must; otherwise, the whole result will be affected.

Want to start FVG Trading

Open an account with Beirman Capital and trade diverse financial instruments using a variety of trade strategies.

FAQ-

What is a fair value gap?

A Fair value gap is a technical analysis scenario that occurs during an imbalance between the buyers and sellers in the market.

How to trade fair value gaps?

Look for FV gaps. When the price reverts to the gap, traders can consider opening a position in the direction of the trend, hoping a price continuation.

What is a price gap in forex?

A price gap occurs in forex when there is a difference between the closing price of a period and the opening price of the next period.

What is the best indicator for fair value gaps?

The fair value gap scanner is the best indicator to spot fair value gaps.

Get Complete Forex Trading Assistance