What is leverage in Forex Trading

Leverage is the most important tool for trading in forex. Let us have a detailed study of what leverage is and how it works with examples, pros & cons.

Leverage is the most essential tool for trading in currencies. You can make a considerable amount of profit using this facility. However, it is essential to have practical knowledge of what leverage is and how to use it in forex trading to eliminate the chances of losses. In this article, we will discuss the complex concept of leverage in the simplest manner.

What is Leverage in Forex trading?

Leverage can be defined as a loan or a facility provided by a forex broker to a trader. The main aim of leverage is to allow traders to open large positions with small account balances.

It is also known as borrowed money. The scope of leverage is not limited to the forex market; traders trading in gold, stock, cryptocurrencies, energies and other securities can use this facility.

Let’s understand the concept of Leverage in forex with examples. Suppose a trader has an account balance of 5000 USD and can take leverage up to 1:500.

In this case, he can place a trade worth 500000 with a capital of 500 USD. The trader buys the USD/EUR pair at 1.1110 and sells at 1.1120. The profit is 10 pips or 0.0010 is equals to 500 USD ( 0.0010 *500,000).

In the above case, the market moves in the favor of traders; however, suppose the trader bought the pair at 1.1110 & Sold at 1.1100, which means the loss is 10 pips or 0.0010 is 500 USD.

So in this example, we have learned how a trader can make and lose a significant amount using leverage. Therefore it is essential to use this powerful tool efficiently.

How does leverage work in forex trading

There is a close relationship between leverage and margin; in order to understand how leverage works, it is essential to understand the concept of margin.

Margin refers to the amount a trader needs to maintain to open a position and use leverage. Suppose you want to open a position of 5000 USD, and the ratio is 1:100.

So here, the margin requirement is 1%, meaning you should have an account balance of 50 USD to open a position of 5000.

Margin is of two types Used and usable. Now you have an account balance of 100 USD. You have already opened a position of 5000 USD, so 50 USD of your account balance is locked, which is the used margin.

Free margin = Equity – Used margin

= 100 – 50

= 50 USD

In this case, if a trader used the free margin, he would get a margin call from the broker to deposit more funds. Also, the trader will not be able to place a trade until he deposits more.

Types of Leverage Ratios

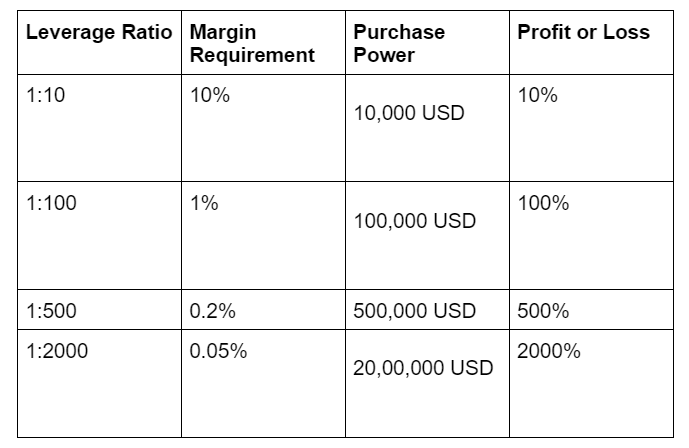

Forex broker offers different ratio depending on capital, country, regulations and other factors. Let us look at some popular ratios with Margin requirement, Purchase Power and return on investment.

Trader with Account Balance of 1000 USD

In the above leverage ratio chart, we have seen the more the ratio, the more the purchasing power and the less the margin. However, remember the profit or loss is also huge with high ratios.

Many forex brokers offer unexpectedly high ratios to lure the trader. Advanced and professional traders who afford to take high risks can go for high ratios like 1: 1000 or 1: 2000.

However, the best leverage for beginners should be from 1:10 to 1:50. Traders should avoid taking leverage more than 1:100. It may significantly affect the return on the investment.

It can exceed profit as well as loss from a trade. So a trader must master the art of leverage management to eliminate the chances of significant risk.

Pros & Cons of Leverage

Leverage is an excellent trading tool with some benefits and limitations. So let us discuss its pros and cons to determine whether using it will be fruitful for you.

Pros of Leverage

Great Profit

One of the key advantages is you can make a significant amount of money using leverage. You may hear of people making enormous money in trading, and the reason is leverage. It allows the trader to enter large positions with limited capital.

Excellent tool for advanced traders

Leverage is a great tool for professional traders who have a greater understanding of the market

Scalpers and day traders who daily invest a large amount in the forex market get huge benefits from this facility.

Investment Diversification

It helps traders to diversify their portfolios by investing in different currency pairs. Diversification helps to manage the losses from one trade to the profit from another.

Let us understand it by example. Suppose you are trading with a 1:100 ratio, and your capital is 1000 USD. So now you can place several trades worth 100,000 USD instead of placing a single trade.

Small Capital Requirement

Leverage can be a good option for traders with small account balances. It allows them to open large positions and make a big profit with a small investment.

Cons of Leverage

Knowledge & Skills

Using leverage is more challenging than it looks; it requires analytical, money, emotional, and risk management skills. It also requires patience, discipline and continuous losses.

It is only suitable for some forex traders. If you are using this power without proper knowledge and market understanding, then it may result in negative outcomes.

Continuous Watch

Traders have to keep an eye on current market conditions while trading in currencies. One major announcement or event may change the whole market scenario.

So it is essential for traders using leverage to continuously monitor sentimental, fundamental and technical analysis factors and adjust their strategy accordingly.

Risky Process

Be prepared for the loss if you are using the leverage technique. Forex trading is a risky process, and leverage further increases the amount of risk.

Even after implementing your strategy efficiently, there are chances of loss. So always try to maintain your risk-to-reward ratio and learn to deal with unfavorable outcomes.

Regulation

No single financial institution regulates or controls the foreign exchange market. However, local financial authorities may form rules for traders and brokers under their boundaries.

As leverage involves significant risks, the financial authorities of different countries have formed restrictions. So you have to first check the leverage limit of your country.

Margin Call

Another disadvantage of excessive leverage is it may result in a margin call. Traders have to maintain a percentage of the trade in their accounts.

Many traders blow their account balance and get calls from their broker to deposit more funds. In such cases, traders cannot place any trade until they deposit more money.

Conclusion

We had a detailed study of what leverage is in Forex Trading. It is also known as a double-edged sword due to its complexity, risk and negative outcomes.

Many traders take excessively high leverage and many traders do not take any leverage due to fear of losing money. However, neither approach is good.

If you want to make money, you have to take a significant amount of risk too. Leverage is a powerful trading tool for making money in the market. You just have to use the proper trading psychology, risk management, effective trading approach, and logical decision-making for desired results.

FAQ

What does 500 1 leverage mean in forex?

500:1 leverage means that with a capital of $1 a trader can open a trade worth of $500.

What is a good leverage for forex?

The leverage up to 100:1 is good for forex.

How much is $100 with 10x leverage?

With 10x leverage $100 is worth around $1000.

What leverage is good for $100 forex?

The leverage ratio of 50:1 is good for $100 forex.

What leverage should a beginner use?

Leverage increases the trading risk. So a beginner should use low leverage somewhere between 10:1 and 50:1.

Get Complete Forex Trading Assistance