What is a Lot in the Forex Market

Lot is a standardized unit of measurement to buy or sell currencies. Let us understand what a lot is in forex with types and its calculations with examples.

Table of Contents

The world of forex Trading is full of complex terminologies. Understanding these terms is crucial to survive in the most dynamic market. In this article, we will have a detailed study of what a lot is in the forex market, its types, and how to determine the right lot size to trade efficiently.

Have you ever bought bananas or eggs? If yes, then you must have heard the word ‘Dozen.’ Bananas or eggs are usually bought and sold in dozens, where one dozen equals 12 bananas or eggs.

Similarly, the metrics to exchange wheat are quintal. Just like that, currencies in the foreign exchange market are bought and sold in lots.

When you trade in large quantities, it becomes difficult to calculate the overall profit or loss. These measuring units help in making such calculations easy.

What is a lot in the forex market?

Lot is a standardized unit of measurement to buy or sell financial instruments like currencies or comex products.

The Lot size enables traders to trade in specific amounts, making the whole process smooth and hassle-free.

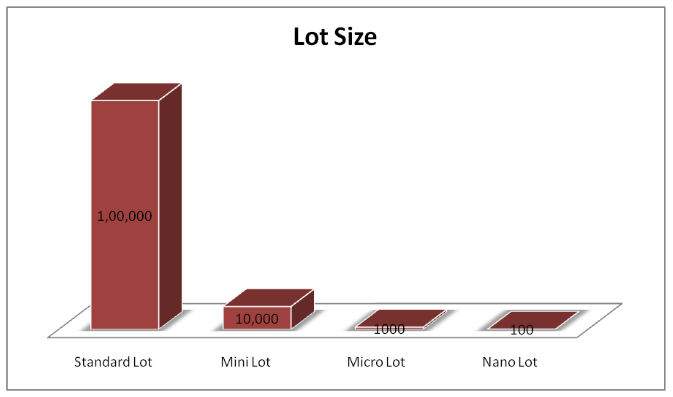

Types of Forex Lot Size

There are different types of lot sizes in forex. Let us discuss each type with its key features to help you select the best trade size based on your needs.

Standard Lot

It is the most popular and largest lot size, generally used by advanced and professional traders. One standard lot in forex represents the group of 100,000 currency units.

It is the biggest lot size, so the profit or loss associated with the trade is also big, making it risky for beginners or novice traders. Suppose a trader bought the standard lot of EUR/USD pair at 1.1150.

It means one EURO equals 1.1150 USD, which means he bought 100,000 EURO or a standard lot for 111,500 USD.

Mini Lot

It is one-tenth of the standard lot containing 10,000 units. Mini lot is the average lot size, not so big or small, making it suitable for all sorts of traders.

Suppose a trader bought a mini lot of EUR/USD pair at 1.1150. It means he has bought 10,000 EURO for 11150 USD.

Micro Lot

It is a group of 1000 units of currencies. Novice traders or beginners should start trading in micro lots. These are less risky and require low capital to trade.

The amount of profit and loss both are small in such lots. Suppose a trader bought a micro lot of EUR/USD pair at 1.1150. It means he has bought 1000 EURO for 1115 USD.

Nano Lot

These are the smallest and rarest lot sizes, containing 100 units of currencies. No doubt, the risk associated with nano lot is very low; however, the trade opportunities, profit, or loss are also limited.

In addition, only some brokers offer the facility to trade in nano lots, and that too with limited services.

Suppose a trader bought a nano lot of EUR/USD pair at the rate of 1.1150. It means he has bought 100 EURO for 111.5 USD.

Profit or loss calculation with a Lot size

We have understood what a lot is in the forex market and its types. Now, let us understand how to determine the overall profit or loss considering the lot size.

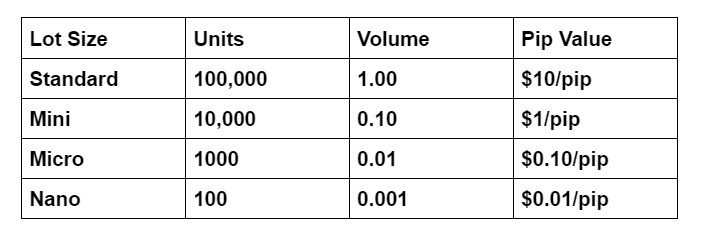

Lot and pip in forex are crucial elements to determine the trading outcomes. This table shows how the volume and pip value change based on the trade size.

Suppose a trader bought a standard lot of EUR/USD pair at 1.1450 and sold it at 1.1500. It means the pip value equals 0.0050 or 50 pips (1.1500-1.1450).

The profit with a standard lot is 10 Dollars per pip. So the profit is 500 USD (50*10). That’s how this table helps you in calculating the trading outcome.

How to determine the right lot size

We have understood what is a lot in the forex market. However, it is not enough. One of the most common questions of beginners is how to calculate the lot size.

Selecting an appropriate lot size is an art; for mastering this art, you must consider some factors. Let us discuss these factors:

Financial Instrument

The market conditions like volatility, liquidity, popularity, stability, etc. differ for different financial assets. So, for selecting the right lot size, it is essential to study these factors.

Consider Risk And Leverage

A trader should consider money management factors like trading capital, risk-to-reward ratio, leverage ratio, etc., for choosing an appropriate lot size.

Remember, the bigger the lot size, the bigger the risk; the smaller the lot size, the smaller the risk. Many traders use the 1% rule, meaning they risk one percent of the trading capital per trade, while some trade in a specific risk-to-reward ratio. These things directly affect the lot size choice.

Trading Outcome

Another important aspect you should consider when selecting the lot size is your expectation from the market.

Each trader has different expectations and risk-taking abilities in the market. You should select the lot size based on the pip you expect per trade.

Trading Strategy

Your trading style also affects the lot size choice; a change in the trading strategy causes a change in lot size. Generally, scalpers or day traders with the aim of short-profit trade in small lot size.

Meanwhile, position, price action, or swing traders go for big lot sizes to make large money.

Wrapping Up

Lot is one of the basic yet important terms of forex trading. Many traders select the lot size without proper research or analysis. However, that’s not the right approach for dealing in the currency market.

The lot size will directly impact your profit or loss, strategy, risk, leverage, and overall trade. So, it is a must for a trader to get well-versed in the trading market and terminologies to trade efficiently.

FAQ

What is the value of 1 lot in forex?

The value of 1 lot depends on the type of lot:

1 Standard Lot = 100,000 currency units

1 Mini Lot: 10,000 units

1 Micro Lot: 1000 units

1 Nano Lots: 100 units

What does 0.01 lot size mean?

0.01 Lot Size is also known as Micro lot which is equal to 1000 currency units.

How many pips is a lot?

Refer to the below table:

| Lot Size | Pip Value |

|---|---|

| Standard | $10/pip |

| Mini | $1/pip |

| Micro | $0.10/pip |

| Nano | $0.01/pip |

How do you calculate lot size?

Lot Size = (Account Balance x Risk %) / (Stop Loss in Pips x Value per Pip).

What is the standard lot in forex trading?

The standard lot size is the most popular and largest lot size, generally used by advanced and professional traders. One standard lot in forex represents the group of 100,000 currency units.

Get Complete Forex Trading Assistance