Forex Market Structure

Understanding forex market structures, its features & participants

Table of Contents

Have you ever met a person who doesn’t know about forex trading? Well, you may have. There are many people like that. When it comes to the stock market, normally, people are aware of it, or they may have heard its name. That’s the reason why people prefer stock trading over forex. However, you will be surprised that the forex market is the biggest financial market, even bigger than the stock market. Let us understand the forex market structure, participants and features. It will help you in starting your currency trading expedition.

Introduction to the Forex Market Structure

The foreign exchange market is the biggest and most liquid financial market. It is an over-the-counter market; more than $6.6 trillion transactions occur daily over the internet.

You can trade over 180 legal currency pairs in the foreign exchange market. The US Dollar is the strongest currency, followed by the Euro and Japanese Yen. A significant part of foreign exchange transactions occurs in these three currencies.

The Forex market is divided into four major sections: London, North America, Tokyo and Sydney. North American and London sessions offer excellent liquidity. As a result, most transactions occur during these market hours.

Trading in forex is quite similar to stock and gold trading. The major difference is in the forex market; traders invest in the currencies. Another important aspect is that you can make profit from forex both by buying and selling currencies.

While we have understood the key features of the forex market structure, there is one major element we are missing, and it is who controls the biggest financial market.

Generally, in the financial market, there is a respective central authority or institution that regulates the market. Like in the stock market, there is the New York Stock Exchange.

But you will surprised to know that the forex market is decentralized. There is no single centralized institution or physical location that controls or regulates the forex market.

Now, the question is, without any authority or centralized institution, how do trading activities in the biggest market with many buyers and sellers take place? Well, to understand this, let us have a look at forex market structure patterns or ladder.

Market structure in forex

Who do you feel participates in forex market activities? Traders. Yes, but do you know traders are on the last step of our market ladder?

The Forex market comprises big banks, governments, firms, companies, and individuals. Let us have a look at each participant’s role and features for a better understanding.

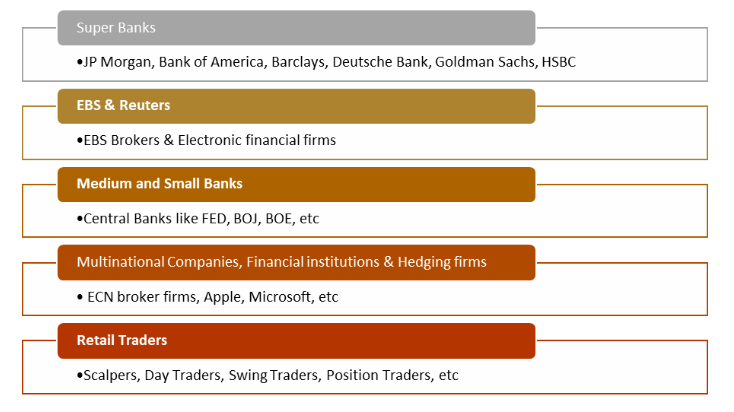

Forex Market Hierarchy

Super Banks

We have studied that nobody controls the activities of the forex market. Well, that’s true, but one can influence the actions.

The first and most important part of our market structure are major banks, interbanks or interdealers. These are the world’s biggest banks that make huge currency transactions daily.

These are also known as forex market makers, as their high-impact transactions influence the currency exchange rate. These interbank or interdealer banks directly connect with electronic brokers.

JP Morgan, Bank of America, Barclays, Deutsche Bank, Goldman Sachs, HSBC, Union Bank of Switzerland, and Citi Bank are examples of major banks. These entities conduct a major part of forex transactions for different purposes.

EBS & Reuters

A trader can make a profit by buying and selling currencies. However, from where will he do so? The answer is Electronic broking services.

EBS is the bridge between the interbank market and retail traders. They also provide liquidity in the market using the electronic medium and technology.

FX Market is the most liquid market, which means it is easy to find buyers and sellers, and ECNs play a massive role in it. These platforms connect buyers and sellers to exchange currencies.

Medium and Small Banks

1. Central Banks: Almost every country has its central bank. These banks are responsible for issuing the currency, making and implementing monetary policies, supply and demand management, interest rates, etc.

The government of every nation has to maintain a foreign exchange reserve to buy and sell goods and services from other countries. That is the primary reason why central banks engage in trading activities.

Central banks also influence and impact the market activities by making economic announcements or policies that directly or indirectly affect the forex exchange activity in the country.

Federal Reserve, European Central Bank (ECB), Bank of England (BoE), Bank of Japan (BoJ) are the most influential central banks globally.

2. Commercial Banks: Small and Medium commercial, industrial, agriculture and other banks of every country also participate in foreign exchange activities to fulfil their daily activities.

Multinational Companies, Financial institutions & Hedging firms

There are institutions that are making money directly or indirectly from the forex market for their clients or through their clients. Simply put, some participants engage in trading for their businesses. Let us have a look at these participants:

Multinational Companies: Big MNCs are major players in the forex market structure. These companies manufacture, buy and sell products and services in different parts of the world.

These firms engage in foreign activities to facilitate trade transactions effectively and hedge the risk against currency price fluctuation. Let us understand with an example.

Samsung, a South Korean electronic company, import part from countries like Japan, the United States, China, etc. It means that the company, on a daily basis, exchange its native currencies with these foreign currencies.

These market giants make forex activities in such volume that it may have a significant impact on the bid and ask price of a currency pair.

Financial Institutions: Forex Market players like Electronic communication network brokers, financial intermediaries and Hedge firms that make money directly or indirectly are also big participants in the market.

ECN Brokers are no dealing desk brokers. They are not liquidity providers; they just connect buyers with sellers. Many brokers provide financial services to retail traders and make money through commissions or currency spreads.

Also, Hedge or prop firms are major market players. These firms engaged in currency trading activities to make good returns for their clients or big investors.

Retail Traders: Many individuals trade in forex currencies in order to make money from money. The concept of retail trading is simple and based on speculation.

Traders analyze the market conditions and different factors to invest in the right currency pair and make money through exchange rate fluctuation.

In simple words, when traders feel that the price of currency will rise in future, they will buy the pair, and when they think the price will fall, they will sell the pair.

The game of retail trading needs analytical, risk, and emotional management skills. Many traders have earned and lost billions in the market in the history of forex.

However, losses and profits are part and parcel of the trading game. Even in the stock market, the chances of losses are there. So, retail trading can be a profitable expedition.

In order to start retail trading, you have to open an account with a forex broker that provides you with a range of currency pairs, leverage, education, analysis and many other things. You can also open an account with Beirman Capital; we provide all you need to trade at your fingertips.

Conclusion

The Forex market is a vast market with many participants, different trade opportunities, analysis methods, and approaches.

The biggest financial market in the world runs without any central authority or physical location. It can be seen as an advantage or disadvantage of forex trading.

As a decentralized market, it is free from price manipulations, plus you can trade anytime from anywhere. However, with a lack of central authority, the chance of scams and fraud is also there.

A retail trader is like the smallest boat sailing in the ocean with giant ships. Mastering the forex market structure helps you at every stage of trading, from selecting a broker to placing a trade. So get well-versed with the forex structure and start your trading expedition.