Cryptocurrency Trading

Trade in major digital currencies, including Bitcoin, Litecoin, Ethereum, Tether, Cardano, Solana, Dogecoin, and many more. Diversify your investment portfolio and manage your risk with our exceptional services.

THE FUTURE OF INVESTING IS HERE

Why trade Crypto with us?

Trade both rising and falling markets on leverage.

Get access to the safe, secure, and transparent cryptocurrency exchange system.

Get access to personal assistance & expert suggestions 24/7.

Trade in the right cryptocurrency at the right time with our powerful Tools.

Trade in a range of digital coins & expand your profitability.

Open an account in minutes with our hassle-free registration process.

What makes cryptocurrency CFD trading so attractive

Wide range of instruments

Trade in global cryptocurrencies, including Bitcoin, Litecoin, Ethereum, Tether, Cardano, Solana, Dogecoin and many more.

Great Liquidity and High Volume

Enter and exit trade with ease. Take advantage of the cryptocurrency market's excellent liquidity and high volume.

Leverage

The Cryptocurrency Market allows traders to open a large position relative to their Trading capital and make maximum money.

Trade 24/7

The Cryptocurrencies Market remains open for 24 hours and 7 days. Trade in a range of cryptocurrencies at any time, including weekends and major holidays.

Higher Potential Returns

The digital currencies market offers opportunities for making higher potential returns with small capital.

Advance Security

Major Cryptocurrencies are based on excellent blockchain technology and cryptographic features. It means all the transactions are well-recorded, making the exchange system transparent and reliable.

What is Crypto Trading?

Cryptocurrency trading is a process of buying and selling digital currencies, including Bitcoin, Litecoin, and Ethereum and making a profit from their price fluctuations.

What are the benefits of Cryptocurrency Trading

- Global Exposure.

- Low Trading Cost.

- Leverage Trading.

- Peer- to- Peer Transactions.

- Decentralized Market.

- Advance Security with Blockchain Technology.

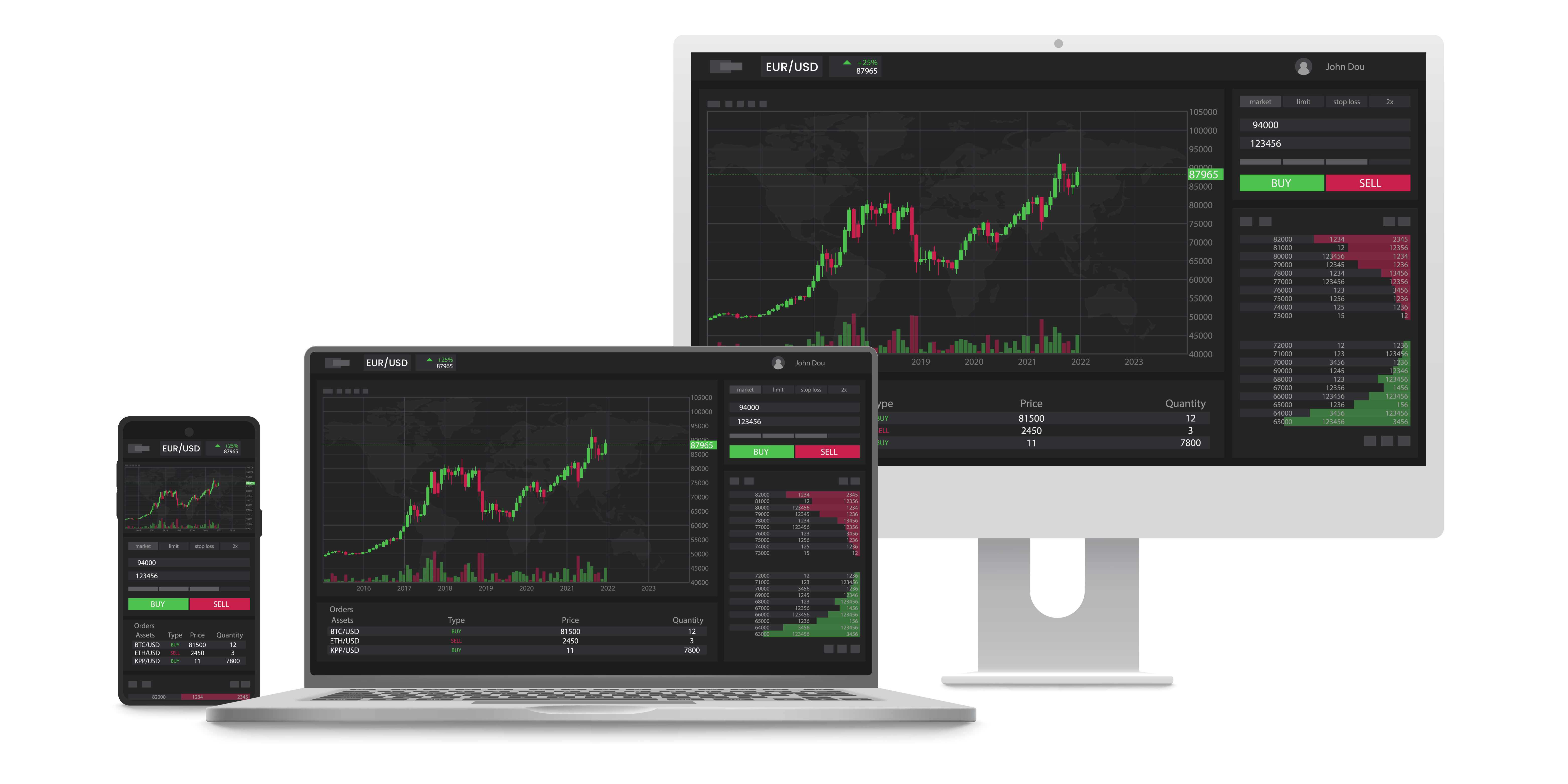

Download MetaTrader 5

How do I Trade in Cryptocurrencies?

- Get yourself well-versed in the cryptocurrency market .

- Identify the cryptocurrencies to trade in.

- Open a Beirman Capital CFD trading account.

- Build a cutting-edge trading plan.

- Choose your trading platform.

- Start your trading journey and place real trades.

Advance Tools

Embrace the power of technical, fundamental, and sentimental analysis in cryptocurrency trading. Get access to exceptional analysis tools on our platform.

Get account opening assistance

We have a quick and easy account opening procedure. However, if you need any further assistance, feel free to connect with us.

FAQ

For long-term crypto investment, established cryptocurrencies with strong fundamentals are generally considered safer options. Assets with high market capitalization, real-world use cases, strong developer activity, and long-term adoption potential tend to perform better over time. Investors often focus on projects related to blockchain infrastructure, decentralized finance (DeFi), and Web3 ecosystems rather than short-term hype coins.

The best crypto to invest in depends on your risk tolerance and investment goals. For beginners, large and well-established cryptocurrencies are often preferred due to their liquidity, security, and market dominance. More experienced investors may look at emerging blockchain projects, layer-2 solutions, or utility-driven altcoins with long-term growth potential.

No, crypto is not dead. While the market goes through cycles of highs and corrections, the underlying blockchain technology, institutional adoption, and global use cases continue to grow. Market downturns are common in crypto and are often part of a natural market cycle, not a sign of permanent failure.

Historically, the crypto market has recovered after every major downturn. While no one can predict exact timelines, market data shows that crypto tends to move in cycles driven by adoption, innovation, and macroeconomic factors. Long-term investors often view downturns as accumulation phases rather than the end of the market.

Yes, most analysts believe crypto will recover over time, as blockchain adoption continues across finance, gaming, AI, and decentralized applications. Recovery depends on factors like regulation clarity, institutional participation, technological upgrades, and global economic conditions, but long-term sentiment around crypto remains positive.